The Power of Planning

Achieve Financial Stability with Strategic Tax Advice, Implementation and Tax Preparation for Small Businesses.

- Keep More of Your Hard-Earned Money.

- Create a Lasting Impact and Secure a Legacy with Tax Advice and Implementation

- Maximize Your Cash Flow with Strategies for Growth and Expansion

We help small business owners achieve their goals by optimizing their tax strategies.

At Joshua Jordan CPA, our team is dedicated to helping you keep more of your hard-earned money, so you can grow your business faster, spend quality time with your loved ones, and build a secure financial future. With our guidance and support, you can start on a path toward the financial stability and peace of mind you need to succeed in business and in life.

The Struggle of Small Business Owners:

Working Hard, Earning Little (And How to Fix That)

Being a small business owner can be tough!

It's like having a baby that never grows up, and instead of getting cuter, it just gets more expensive. Small business owners are often faced with the challenge of working long hours and still struggling to make ends meet. Despite their best efforts, many small business owners find themselves earning little income, often barely enough to cover their expenses.

Thriving, Not Just Surviving

The pressure of trying to keep the business afloat while also juggling personal responsibilities can be overwhelming, leading to burnout and stress. This struggle is all too common among small business owners, who are often passionate about their work but may lack the resources and support needed to achieve financial stability. It's no wonder small business owners are the hardest working and least paid people on the planet. But fear not, all is not lost!

work less and earn more

By working smarter, not harder, and planning for the future, small business owners can unlock their finances and achieve greater success. So, let's raise a glass to all the small business owners out there - here's to working less and earning more!

Are You Tired of the Old Way of Doing Taxes?

Have you ever Handed over Your Documents and Prayed for the Best – Only to Be Slapped with a Massive Bill You Didn't See Coming? Without Guidance or Planning, You Could Be Missing out on Huge Savings and Facing Surprise Tax Bills from the IRS.

But There's a Better Way.

We are changing the game, because we believe in making life easier for business owners. You are not a tax expert, but you can have a CPA on your team to increase your cash flow, improve your life and reach your goals faster. We Offer Upfront Pricing and Year-Round Planning to Avoid Surprise Bills and Implement Strategies That Save You Money.

Hey Small Business OWner!

No one tells you how hard it is to run a business before you dive in head first.

It can feel pointless when all your hard earned money goes to your tax bill. I know, I’ve been there. In the first years of my business, I was making way too little for how hard I was working. I didn’t know how long I could keep going, or if I should stop and go back to the corporate job I quit.

What if I told you there was another way to approach your business and taxes?

Unlock the power of Planning

Listen, we get it – taxes aren't exactly the most exciting part of running a business. But here's the thing: without a solid tax strategy, you could be draining your cash flow faster than a leaky faucet. And let's face it, slow progress toward your life and business goals is no fun for anyone.

That's where we come in. Our tax planning team is here to help you take the stress out of taxes, and put the fun back into achieving your dreams.

By optimizing your tax strategies, we can help you keep more money in your pocket – and hey, who doesn't like more money, right?

With the financial freedom and peace of mind that comes with strategic tax planning, you'll be empowered to make the most of every opportunity, both in business and in life. So, whether your goal is to grow your business, spend more time with your loved ones, or build up your rainy-day fund (or maybe all of the above), we're here to help you get there faster.

Don't let a lack of tax strategy hold you back – let's work together to make your dreams a reality!

The High Price of Ignoring Tax Advice

Why Tax Advice is a Must-Have for Small Business Owners

Taking Control of Your Taxes

Gain peace of mind knowing your taxes are in good hands.

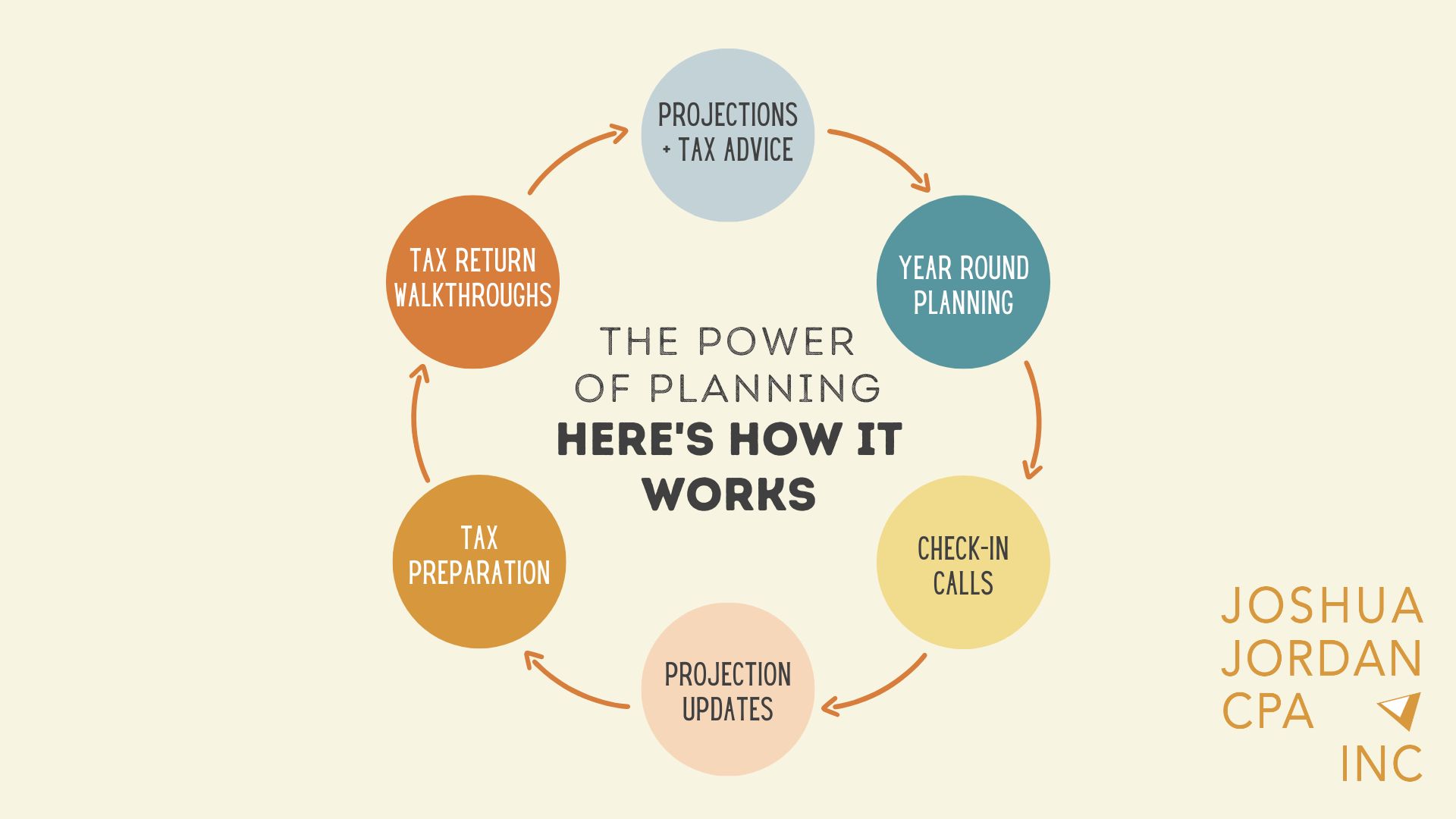

Our Unique Process

Working with a tax planner can make a big difference for small business owners – it's like hiring a personal trainer for your finances. By optimizing tax strategies and reducing your tax liability, you can build up your financial muscles and increase your cash flow. Plus, you'll reduce your risk of audit, avoid common mistakes, and improve your financial management skills. And let's be honest, there's nothing more satisfying than knowing that your taxes are in good hands, so you can kick back and relax. So, if you're ready to get in shape financially and achieve measurable results, let's work together – I promise, I won't make you do any burpees.

No more surprise bills!

STAY ON TOP OF OPPORTUNITIES TO UNLOCK MONEY

At Joshua Jordan CPA, we're not just about preparing your taxes and calling it a day – we're all about looking ahead to see what we can do to set you up for success. That means being proactive, not reactive. We take a close look at your financial information to identify future situations, set up systems to remove confusion about your taxes, and provide you with the audit armor you need to feel confident in your numbers.

But we don't stop there. We're with you every step of the way, checking in throughout the year to see how you're doing and helping you make big moves when the opportunity arises. We even schedule time to work on your tax return, so you know exactly when it will be done. And when it's time to review your return, we'll walk you through what happened, where you stand, and start discussing changes for the next year.

This process keeps you informed, prepared, and in control of your finances. You'll be able to make tax payments throughout the year and avoid those shocking tax bills that drain your bank account. We offer upfront transparent pricing for our services with monthly subscription billing. At our company, we believe that being proactive is the key to success – and we're here to help you achieve your goals.

Ready?

With a little financial planning and some clever strategies,

small business owners can break free from this vicious cycle and start making the big bucks they deserve.

Don't Let Bad Tax Advice and Preparation Sink Your Business:

MEET THE CPA WHO'S HERE TO HELP

Hey there, I'm Joshua Jordan– a former controller for a small ad agency turned CPA and small business owner. Over the last 10+ years, I've seen it all – the good, the bad, and the ugly – when it comes to small business accounting and tax prep. And let me tell you, some of it was downright hilarious (in a painful, cringe-worthy kind of way).

After years of untangling accounting choices that had created a financial mess for the ad agency where I worked, I felt like a superhero – a nerdy, number-crunching superhero, but a superhero nonetheless. The systems I put into place allowed the decision-makers to make timely informed choices and grow the business in the right direction. This experience lit up my inner detective and sparked the desire to help other small businesses avoid the same fate, but not with their accounting. I chose to focus on something more complicated, frustrating, and devastating for business owners who get it wrong.

The US tax code is a maze that even the most experienced business owners struggle to navigate.

Watching business owners take on the tax code on their own is like watching a bunch of toddlers trying to build a sandcastle without any buckets or shovels – frustrating, messy, and bound to end in tears. That's why I decided to focus on tax advisory and preparation.

I was sick of seeing bad systems tripping up well-intentioned business owners. So, I decided it was time to start my own business. Plus, to be honest, my son was born and I realized that I wanted more time and flexibility in my schedule to be present for my family. My calling is to help other small business owners build a legacy while achieving the same kind of flexibility with time and money.

So, I hung up my corporate hat (figuratively, of course – I look terrible in hats) and set out on my own. Now, I'm here to help small business owners like you navigate the murky waters of tax planning and preparation with humor, wit, and a whole lot of expertise. Because let's face it, tax planning can be a dry subject – but it doesn't have to be. So, if you're ready to take your business to the next level, let's chat.

Joshua Jordan

The High Price of Ignoring Tax Advice

Why Tax Advice is a Must-Have for Small Business Owners

Taking Control of Your Taxes

Gain peace of mind knowing your taxes are in good hands.

Does this sound like you?

Self-Employed

If you are a self-employed entrepreneur, or own a business with your spouse.

80K+

If your business generates at least 80k in annual profit (or will).

Here’s how we can help you move the needle:

Better Decision Making

You’ll be able to make business and financial decisions with confidence, knowing how much of the money is “yours” to keep.

Accurate & On-Time Filing

Your tax returns will be filed accurately, on-time. You’ll know with certainty when to expect your tax returns to be finished.

Faster Growth + More Freedom

You’ll have more resources available to grow your business faster, spend quality time with family and friends, and build up a rainy-day/emergency/opportunity fund.

No Surprise Bills

You won’t be surprised by massive tax bills every April.