When you drive your car for work, it probably doesn’t show up on your Statement of Profit and Loss, but it could be a significant tax deduction for your small business.

If you aren’t keeping good records of your business miles, you could be needlessly throwing away hundreds (or thousands) of dollars every year, by not deducting the business use of your vehicle.

Now, I’m not talking about commuting miles. The IRS makes it very clear that commuting back and forth to your place of work is a personal expense that is not deductible.

But, if you regularly use your vehicle to drive from your office to meet with clients or vendors, that mileage can add up to a big tax deduction.

How Big? I’ve seen situations where the deduction is over ten thousand dollars! Between self-employment, federal and state taxes, missing that deduction could cost thousands of dollars every year.

Even if you aren’t a road warrior, logging 20k+ business miles every year, keeping track of your mileage can still pay off handsomely.

But how do you do it?

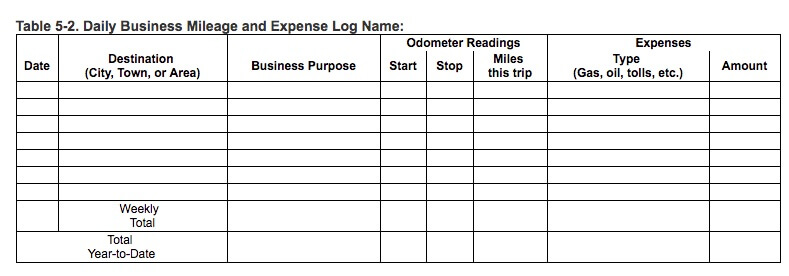

Well, it used to be that you would keep a mileage log in your vehicle. You would write down the date, destination, business purpose, odometer readings and mileage and any related vehicle expenses for every use of your vehicle for business purposes.

That type of log might look something like this (from IRS Publication 463):

This year, I’m seeing a lot of my clients using apps on their smartphones that track the mileage for them.

The most popular app will automatically record all of their drives, and then they just have to classify them as business or personal by swiping left or right and adding in the business purpose for each trip.

At the end of the year, they give me a copy of the report that the app generates, and I can calculate the amount that will be deductible on their taxes.

Whether you choose to go analog or digital with your mileage log, just make sure you do it! Each business mile that you forget is costing you money on your taxes, and it can add up quick.

Need to get your taxes done, and looking for a CPA that likes helping small businesses make sure they aren’t missing “hidden” tax deductions like this? We may be able to help.

Click here to learn more.

-Josh